Navigating California's sales tax system can be complex. This guide simplifies the process, focusing on the Long Beach sales tax rate for 2025, helping businesses and consumers avoid costly mistakes. We'll break down the system, provide step-by-step calculations, and point you to reliable resources.

Understanding California's Sales Tax Structure

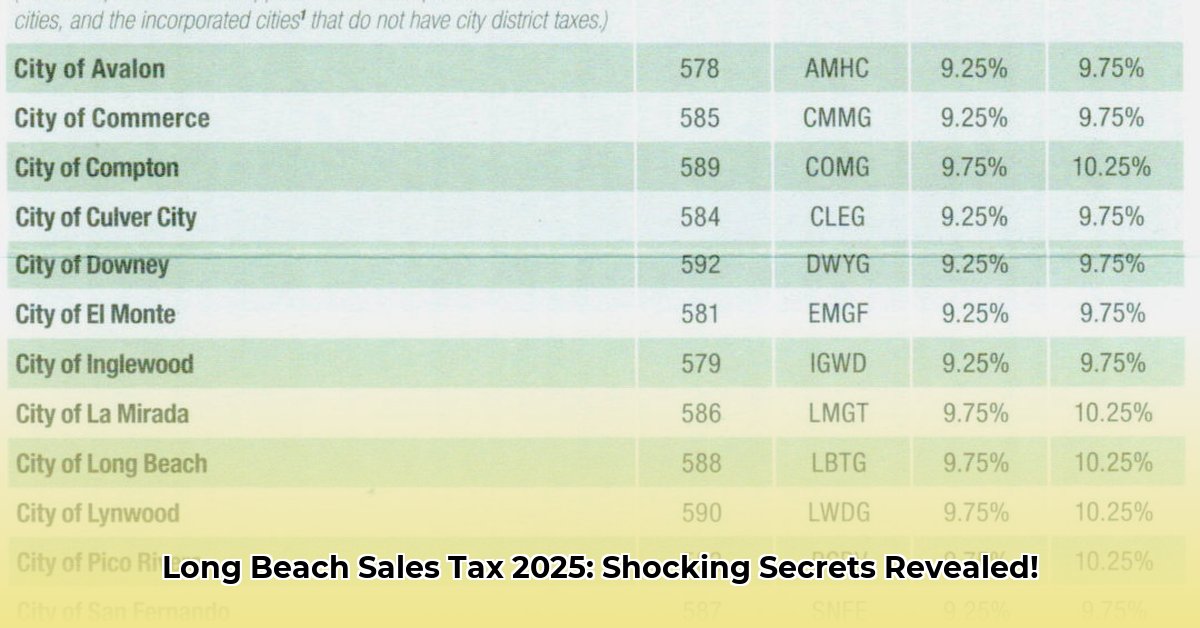

California's sales tax isn't a single rate; it's a layered system. The base is the state sales tax, currently 7.25% (6% state rate + 1.25% district tax). However, cities and counties can add their own local sales taxes, resulting in different rates depending on location. This means the final sales tax you pay is the sum of the state rate and any applicable local taxes. Are you ready to understand how it applies to your purchases in Long Beach?

Long Beach Sales Tax: Location Matters

Long Beach adds its own local sales tax to the state rate, resulting in a higher total. Unfortunately, there isn't one single Long Beach sales tax rate. The exact rate depends on the specific location of the sale within the city limits. To find the precise rate for a given address, consult the California Department of Tax and Fee Administration (CDTFA) website (https://www.cdtfa.ca.gov/taxes-and-fees/rates.aspx) or a reputable online sales tax calculator that uses zip codes. Why is location so important? A small difference in location can impact your final tax bill.

Calculating Your Long Beach Sales Tax: A Step-by-Step Guide

Here's how to calculate the sales tax for your purchases in Long Beach:

- Determine the Pre-Tax Price: Find the price of the item before any taxes are added.

- Identify the Total Sales Tax Rate: Use the CDTFA website or a reliable online calculator to find the combined state and local sales tax rate for the specific location of your purchase. Remember to check for any special district taxes. This is crucial for accuracy.

- Convert the Rate to a Decimal: Divide the total sales tax percentage by 100 (e.g., 9% becomes 0.09).

- Calculate the Sales Tax: Multiply the pre-tax price by the decimal rate.

- Calculate the Total Price: Add the sales tax to the pre-tax price.

Example: A $100 item with a combined sales tax rate of 9% in a specific area of Long Beach:

- $100 (price) x 0.09 (tax rate) = $9 (sales tax)

- $100 (price) + $9 (sales tax) = $109 (total price)

Isn't that simple? But remember, the accuracy hinges on correctly identifying the total sales tax rate.

Reliable Tools and Resources

Accurate sales tax calculation is essential. Here are trustworthy resources:

- CDTFA Website: The official source for California sales tax rates. Use this to verify any rate you find elsewhere. This is the number one resource!

- Reputable Online Sales Tax Calculators: Many free online calculators exist; however, always verify their results with the CDTFA website.

- Tax Software: Specialized software for businesses simplifies sales tax calculation and compliance.

Using these resources helps ensure accuracy and avoids potential penalties.

Compliance and Penalties: The Importance of Accuracy

Incorrect sales tax calculation can lead to significant penalties for both businesses and consumers. Businesses are responsible for correctly collecting and remitting sales taxes. Failure to do so can result in substantial fines and legal action. Consumers should be aware of their rights and potential recourse actions if they've been overcharged. What happens if you're not compliant? It can be costly, so be sure you are doing it right.

Staying Informed: Keeping Up with Changes

Sales tax rates can change. Regularly check the CDTFA website for updates. Proactive monitoring is crucial for accurate calculations and compliance. Remember, staying informed safeguards your finances.

Key Takeaways:

- California's sales tax is a layered system, combining state and local rates.

- Long Beach's sales tax rate varies by location within the city; using the CDTFA website is essential for accurate calculations.

- Reliable online tools and resources help streamline the calculation process, but verification with official sources is crucial.

- Compliance is vital; inaccurate calculations can result in penalties.

By following these steps and using the resources provided, you can confidently navigate Long Beach’s sales tax system and avoid potential financial pitfalls.